- Personal Introduction

- Fundamental building blocks of financial independence.

- Enhancing your Income

- Saving more money

- Investing for beginners

- How to retire before 40.

- Issues to consider before leaving the workforce.

Escaping the Rat-Race

Hacker's Edition

Christopher Ng Wai Chung

Author and Financial Blogger - treeofprosperity.blogspot.com

Overview

Personal Introduction

- Trained as an electrical engineer in 1999.

- Studied finance part-time in 2001 - Passed CFA exams in 2003.

- Published 3 books in personal finance while working as an IT project manager in P&G, HP, SMX, NTUC and IDA.

- Became financially independent at age 39.

- Will start law school this August.

Fundamental Building blocks of financial independence

- State of affairs where investment income exceeds living expenses.

- You can ramp down your work, reinvent yourself or simply do nothing with your life.

- Requires three skills of earning, saving and investing.

Enhancing your earnings.

- First key skill - enhancing your earnings.

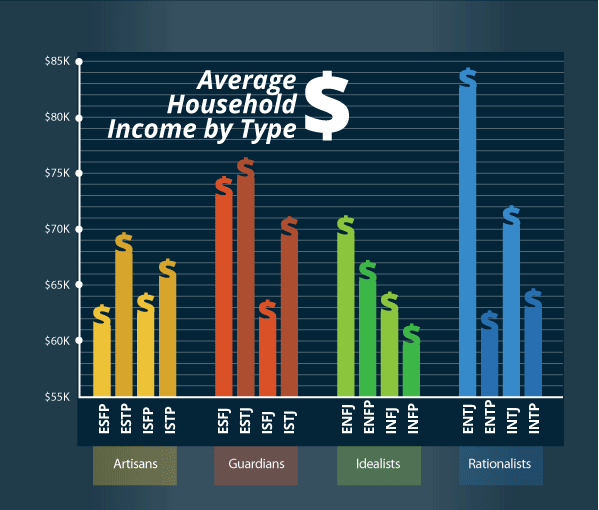

- Know what job suits your personality - take the Gallup Strengthfinder. Know your MBTI. Know your OCEAN.

- Manuever your career to at least 8% increments. Perform better, work overtime.

- Increase business revenue, reduce business costs.

- If HR policy permits, moonlight.

- Build an app, write a book.

Effects on personality on income.

Saving more money

- Second key skill - totally within your personal control.

- Examine your monthly expenses. YNAB

- Cut down non-essential expenses. ( Eliminate vices, consolidate fixed expenses )

- Downgrade aggressively. Starbucks -> Kopitiam. Restaurant -> Hawker Centres

- Develop cheap hobbies like reading. Read about investment.

Investing for beginners

- Some risk must be taken to overcome inflation.

- Consider equity performance for your portfolio.

- Beginners can balance a portfolio among equities, bond and commodities.

- Observe concepts of risk and return. ( See Shiny App )

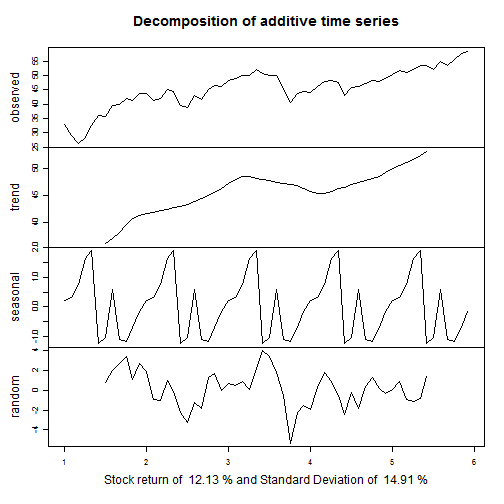

Behavior of World Equities

## NULL

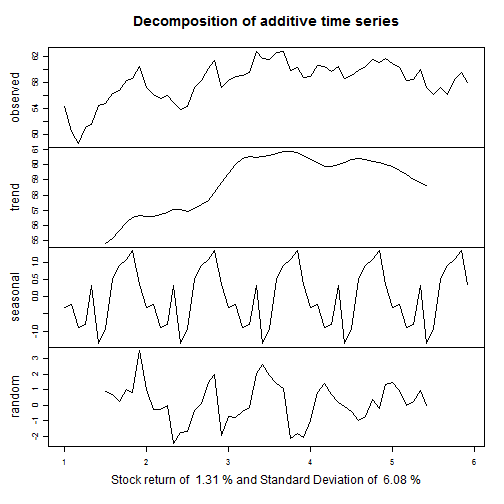

Behavior of World Bonds

## NULL

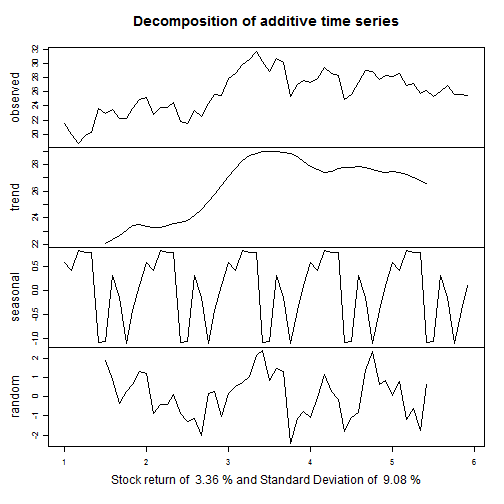

Behavior of Commodities

## NULL

Correlation

- Correlation between stocks and bonds : 0.6553079

- Correlation between stocks and commodities : 0.7229404

- Correlation between bonds and commodities : 0.553332

How to Retire before 40.

- Stay with parents, stay single longer.

- Employ REITs, business trusts and high yielding equities to target 6-9% dividend yields.

- Use dividends to offset living expenses.

- Invest your salary into the markets.

- Aim to live solely on dividend income.

- Meet life goals of building a family.

Eg. $300,000 portfolio yielding 8% will give $24,000 a year ir $2,000 a month. This can sustain a single man.

- Need to comply with Securities and Futures Act. Cannot advise on which stock to buy.

Issues to consider before leaving the workforce.

- This process will usually take 15 years for a fresh graduate.

- Work will take up most of your life.

- You will need to consider your personal identity.

- How to spend your time meaningfully.

- You can buy happiness with money but that is also a skill set.

Financial Independence is within your reach.

- Work hard.

- Save Aggressively

- Know how to invest your money.

Any questions ?